World capitalism accelerates the transition to a new economic crak and more social polarization

The world capitalist economy generates uncertainties and increasing clashes. On Wednesday 19 from December to 2018 la FED, the US central bank, It produced the fourth increase in the interest rate benchmark 2018 and the ninth since December 2015, he did against the demands of Trump subsequently threatened to fire the head of that institution.

Y, although the "markets" that would occur discounted, the major world markets reacted with a significant drop in share values of corporations and ended installing a widespread feeling of uncertainty in international financial capital.

Public and private debt, especially the large global corporations, growing protectionism expressed first in the trade war between the US and China, under a fragile and questioned "truce", and the slowdown in China's economy, are some of the burning alarms.

For these symptoms international organizations like the IMF and the vast majority of analysts who hold capital, They changed their positive forecasts on the progress of the world economy made recently, the harbinger of a new recession and crisis horizon to the 2020. From Anticapitalists in Net1 we have been warning for months about the imminence of a new crisis of intensity equal to or greater than that of 2008 and trying to explain the structural causes that are dragging the system at the same.

But this objective dynamic is not enough to accurately predict their times, not enough, although necessary, to understand the internal logic of capitalism, of metabolism. They influence the phenomenon and accelerating the pace of its political and geopolitical conditions that result from the same crisis, and simultaneously fed back. Two of these conditions among many others are: a) the anti-power movement in France Yellow Jackets deepening global social polarization and is spread through Europe and, b) Brexit the imminence of which will have important consequences not only for the British economy, it can trigger a domino effect of crisis on the whole of the European Union.

In this text we return on the underlying causes of the economic crisis, which explains its dynamics and reasons why we are in a global situation where what comes are great confrontations and a new peak in the world crisis of capitalism.

Indicators that warn of the possibility of a new crisis are at similar levels in 2007

The situation of the profits or gains of non-financial sector, but still the productive sector in major economies more, the level of global economic growth in these economies, the evolution of both levels of government debt and corporate, the march of world trade are among other indices that predict the possibility of a new peak of the global crisis.

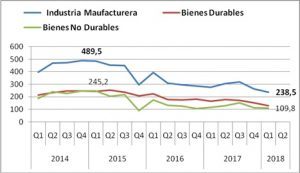

In August 2018 In a study based on data from United States Department of Commerce, Chilean economist Orlando Caputo2 analyzes the situation of the US economy and concluded: that the US manufacturing sector earnings have fallen from 2014 until the second quarter of 2018 in the order of 51,3%. This fall is similar to the figure for 2006 Y 2008 prior to the Great Recession was then fall 53,3%. In the same paper it analyzes the behavior of the profits of production of durable goods sector and non-durable, whose profits also fall similar terms to all manufacturing.

Gains in US manufacturing between 1st. Quarter 2014 and 1st. Quarter 2018. Orlando Caputo calculations with data from the Department of Commerce

But the news from the last month 2018 on the critical situation of two major automotive industries in the US, Ford y General Motors, crisis that has already resulted in the announcement of plant closures and layoff of tens of thousands of workers, is useful to see how does the development of earnings in the sector. According to the study Caputo, Estimates indicate a decline throughout the period studied, but also it shows that a landslide occurs during the period Trump. Falls in automotive earnings from the first quarter of 2017 and the first quarter of 2018, it was of 65,2%.

Gains in the automotive sector. Orlando Caputo data processing with the United States Department of Commerce

Regarding the growth of the world economy all private institutions and some public institutions analysts corrected their forecasts always low. Goldman Sachs, Bank Of América, the Bank for International Settlements (BPI for its acronym in English) among others, and according to these forecasts see a cooling of the US economy and global under high interest rates and continue to grow. This situation is transferred to the field of production. Robert Michael writes on his blog: "The latest report of the real GDP for the Third Quarter 2018 It shows an annual growth rate of real GDP 3,5%. Nevertheless, he 2,1% This GDP growth actually responds to the accumulation of inventory, that is to say, goods that are not sold. At some point production you will have to slow down its speed to output the accumulated inventory. " 3 Something similar happens with investments. It is also distortion caused in 2018 by eliminating taxes on corporations and billionaires that were not derived productive investment but to the buyback of the companies to maintain their quote.

In the same sense of economic slowdown official institutions and analysts are silent on the behavior of the Chinese economy. While the brake on economic growth is quite evident in Europe.

On the other hand the levels of public and private debt exceed those achieved at the end of 2007 Y 2008. Corporate debt has grown exponentially since 2014 producing the extension of the phenomenon known as leverage in an important sector of them. Roberts cites a September report 4that BIS notes that there are a large number of companies to which this institution called zombies. These companies do not have enough income to pay the interest on its debt accumulated. They can not invest and grow and become undead. The BIS says that about 15% of all companies listed on the major economies of the world companies are in that situation.

World trade is also reduced as a result of the trade war that the United States told China. Truce", fragile and unstable, agreed in the context of the G 20 in Buenos Aires, It comes after the consequences of previous protectionist measures were felt in exports of major world economies. According to OECD researchers G205: "Excluding major oil exporters, such as Russia and Saudi Arabia, trade of G20 has stalled, It is suggesting that the continued expansion of the past two years has slowed as a result of recent protectionist measures ".

The data these researchers have on reducing exports the following: in United States, exports were down 1,7%. Exports grew in China (2,4%) but this growth partly reflects the exceptional sale of an oil rig to Brazil, which he helped push up on Brazilian imports 18,0%, this only partly offset the significant contraction in Chinese exports (a 4,9%) in the previous quarter. Exports also contracted in the European Union as a whole (-0,8%), for second consecutive quarter, and Australia (less than 2.0%), Japan (less than 2.0%), South Africa (-0,8%), Turkey (less 0,6 %) and India (less 0,3%).

The trend towards falling rate of profit remains, the cooling of the global economy, the growth of corporate debt to make it an important part unsustainable, and the drastic reduction of international trade, are the seasonings of what appears on the horizon like a very spicy dish, the announcement of a new chapter in the global crisis.

Economic crisis and social polarization

I work in February this year, said Roberts, taking into account a sharp drop in bags like the one that occurred in these days, It was a historical analogy and comparing the present time with the recession unleashed 1937. It describes the moment of the crisis that occurs at the time as a peak after a slight recovery but sustained for five years from 1932, which it was one of the lowest moments from crak 29.

Roberts says there, the recession 1937 only begin to resolve after a strong momentum of the arms industry and the US entry into World War II and add us, its consequences at the level of destruction of capital and productive forces.

But to be effective comparison is also important to add the social and political conditions which then gave. Ten years ranging from crisis 1929 until the outbreak of World War II were years of political upheaval, great social polarization and confrontations. The Civil War in Spain, business occupations and general strikes in France and Italy, as well as strikes in England, are some of the episodes that marked the situation as the second German revolution and China. Understanding this scenario of social polarization is critical to understand that the Second World War and the consolidation of fascism as a historical process of barbarity, It was only possible after crushing defeats of these movements, struggles and revolutions.

And this is because the great economic crisis systemic, as crak 29, that of 2008 and even the next world recession looming as a continuation of the 2008, promote and encourage independent action of the mass movement, deepening polarization.

The historical period in which we are, with its new chapter of economic crisis and its deepening social polarization, Far from being a time of turning right or neo-fascist consolidation projects, opens the revolutionary tremendous opportunity to overcome the capitalist system. The result of this period shall be settled in major confrontations coming. And the struggle is Amarrillos Vests, at this juncture, the first of them.

Carlos Carcione

2 Orlando Caputo sharp decline in profits of US companies. http://www.rebelion.org/noticia.php?id=245593

4 Risks of Enterprises Zombies https://www.bis.org/publ/qtrpdf/r_qt1809g.pdf

reproduced from Anticapitalist Network

30.12.2018